Welcome back to Ed-itorial, where we talk new construction real estate, real consumer insights, and how to stop marketing like it’s 2015.

First, the forecast.

Based on our new Audience Town consumer data, the home mover forecast fell slightly to just over 20M this year.

.png)

This is in-line with August numbers and reflects the general slowness that we've experienced in the market. Not good news, but not new news, either...

At our Audience Town home builder strategy forum last month, Sklar Olsen, former Chief Economist at Zillow, described the housing market as having lots of “thrash,” a term she used repeatedly. She used it to express that some markets are strong, others softening, and they’re changing quickly

So I started wondering about that word, and how the only other use of that word I recalled was for:

Thrash Metal 🎸

As a genre, thrash metal is a subgenre of heavy metal music characterized by its overall aggression and fast tempo. The songs usually use fast percussive beats and low-register guitar riffs, overlaid with shredding-style lead guitar work.

Most thrash metal is bad, but Metallica is very good. The housing market right now is the same way.

And while we may say it’s tough right now, Zillow reminds us that the U.S. housing market added $2.6 trillion in value this year, hitting a record $52 trillion in mid-2025.

Wait, what???

You’re still fighting for traffic, leads, and budget. Inventory is tight. Mobility feels down. Affordability is under pressure.

In other words: there's a lot of "thrash."

The headline number doesn’t tell the whole story. Builders feel the thrash on the ground every day.

Want more proof? Here's a quick pulse check on builder sentiment:

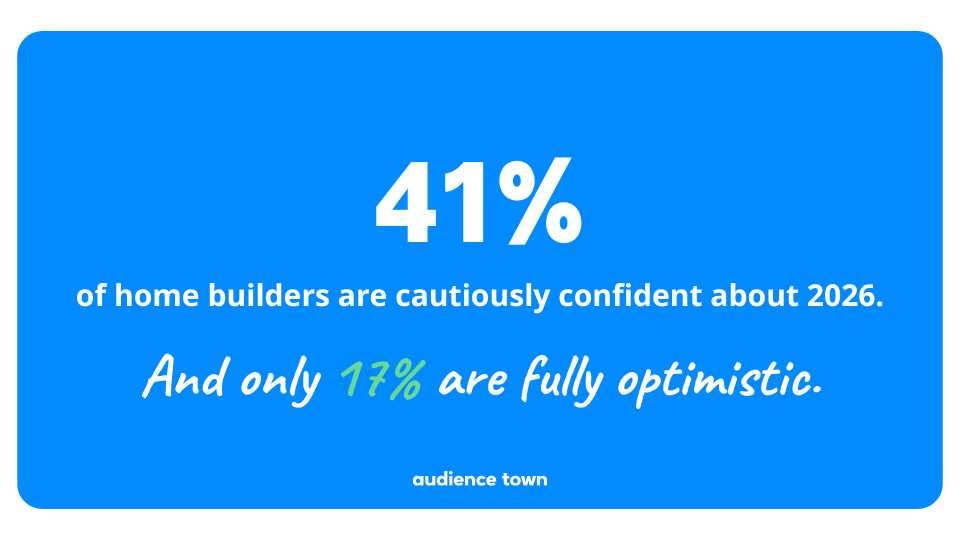

What builders are feeling heading into 2026.

At Plan to Win, this year's home builder strategy forum, builder marketers shared what they’re focused on, and what’s keeping them up at night:

- 60% said hitting or exceeding sales goals is their definition of “winning” in 2026.

- 45% said interest rates are their biggest wildcard.

- 41% described their outlook as cautiously confident.

- Just 17% are fully optimistic.

This shows that we're all feeling the "thrash." We're seeing reasons to be hopeful, but as an industry, are prepped for some continued volatility. I'm going to try to break this down a little more and offer ideas for what you can do about it.

There's no such thing as the "U.S. housing market"

Florida is not Ohio. Texas is not Colorado. Every builder knows this, but headlines treat housing like it's all one story. It’s not.

Right now:

📍 Florida: In-migration is propping up demand. Builders are fighting supply, not interest.

📍 Midwest: Inventory is healthier, but buyers are cautious. Confidence is the issue.

📍 Texas: Growth continues, but every price point is rate-sensitive and volatile.

Same country. Same year. Completely different realities.

National data is helpful directionally, but not for guiding the details of your strategy. Here's why: those national numbers don’t tell you who is moving, where, when, or why. Just to prove the point:

- Pending home sales in August rose 4.0 % month-over-month and were up 3.8 % year-over-year, according to NAR.

- New home sales surged, too. August new‑construction contracts hit a SAAR of 800,000 units, an increase of 20.5 % over July. Some experts expect this to be revised downward, but it’s still an important signal.

- Meanwhile, existing home sales dipped slightly in August, down 0.2 % to a 4.00 million unit annual pace.

These mixed signals (or "thrash") are exactly why local context matters. The national “rebound” in contracts might not hit all markets equally.

The truth is local.

👉 What you can do now:

- Start: Use ZIP-level data to drive both land and marketing decisions.

- Stop: Don't just rely on national forecasts for planning.

- Keep: Benchmarks remains valuable. Take it to the next level by benchmarking against your true competition, not national averages. (Audience Town can help.)

New Construction's Quiet Affordability Advantage

In Q2 2025, the median new home price ($410,800) fell below that of existing homes ($429,400) for the first time in decades.

That wasn’t luck. Builders made it happen: smaller footprints, leaner lots, smart incentives.

New construction accounted for nearly one-third of all housing market value growth in 2025, per Zillow. If you’re marketing new homes, you have the product buyers are actively turning to, especially in markets with tight resale supply.

Audience Town data revealed the following for all residential new construction this year:

- $508.29 per sq. ft (average)

- 5.82% average rate

- 93% are fixed rate

.jpeg)

In other words, new construction has a quiet advantage over used homes right now: affordability. Here’s why:

- Location: New construction communities tend to be built in up-and-coming markets that are more affordable and/or have more upward potential.

- Flexibility: Builders are able to work with buyers on financing the home.

- Affordability: New construction maintenance costs are significantly lower than that of existing homes.

Let’s dig into that last one a bit more.

Skylar Olsen: The Maintenance Math No One Talks About

Maintenance savings are one of the most overlooked advantages of having a new home.

NAHB research shows that buyers of pre-1960 homes should expect to save nearly 1% of home value annually just for maintenance. That can be thousands of dollars every year.

For newer homes, that number is closer to 0.2%.

Former Zillow Chief Economist Skylar Olsen shared in her keynote at our recent Home Builder Strategy Forum, Plan to Win, that, “new construction is often more affordable, especially when you factor in maintenance costs.”

.jpeg)

In a market with stalled price appreciation forecasts, the cost of being house poor is higher than ever. As Olsen explains, “If your home isn’t going to appreciate like it did in the boom years, those upfront savings really matter.”

Builders in affordable regions, especially in the South and parts of the Midwest, can offer long-term financial value that’s hard to ignore.

And when many buyers are stretched thin, affordability is a meaningful differentiator (no matter where you’re located).

👉 What you can do now:

- Highlight: Emphasize total cost of ownership, not just sticker price.

- Compare: Consider adding calculators or “What would you do with an extra $300/month?” moments. Contrast old vs. new creatively in visuals and messaging.

- Communicate: Build campaigns like “Why New Makes More Sense” or “Dollars and Sense of New Construction.”

Think Inventory Is Low? Mobility Is Lower.

New homes might be more available than existing, but we’re still in a supply-constrained market. Many homeowners remain locked into ultra-low mortgage rates, reluctant to sell. As a result, mobility is at a multi-decade low.

As I shared in last month's Ed-Itorial: “In 2019, 40 million Americans moved. This year, we’ll be lucky if it’s half that.”

One of the most fascinating takeaways from Skylar Olsen’s session was how moving behavior has shifted across different age groups…and what that means for how we market new homes.

In her words, there’s “a lot of potential demand in the market,” but that demand is unevenly distributed and shaped by generational factors.

Olsen shared:

👶 Gen Z and younger Millennials (late 20s–early 30s) are moving more, driven by life stage and urgency to buy.

👨👩👧 Middle-aged adults (35–54) are more static; they're often rate-locked, caregiving, or risk-averse.

👵 Boomers (55+) are quietly mobile, especially in affordable lifestyle metros like Charleston, SC.

.jpeg)

Buyers are more pragmatic, more digitally savvy, and more financially strategic than they were even five years ago.

Employment is also a factor here. Despite RTO (return to office) rolling out across multiple sectors, remote work remains sticky. Demand continues to shift toward distant, affordable suburbs and homes with WFH-friendly features.

👉 What you can do now:

- Refresh: Update buyer personas with real behavioral data about your market (not 2019 assumptions.)

- Celebrate: Highlight location, financing flexibility, and lifestyle benefits.

- Tailor: Segment messaging for first-timers, downsizers, and lifestyle relocators.

Audience Town helps you generate more traffic, and better quality leads, by allowing you to see detailed demographics about who is visiting your site, and where your best leads are coming from.

Imagine testing a new campaign, and being able to see if it drove the qualified traffic to your community. That’s the magic of Audience Town. See how it works.

You Can’t Afford to Miss When Demand Shows Up

Skylar nailed it: “There’s potential demand in the market. It’s uncertain...but it’s there.”

Every move matters more, and builders can’t afford to miss when demand does show up. That’s where lead quality, buyer targeting, and speed to lead matter most. At our recent forum:

- 48% of marketers said attributed sales is now their #1 success metric.

- Just 8.7% still measure marketing by website traffic.

It’s clear that the best marketers aren’t just chasing leads anymore; they’re looking for proof. Attribution is no longer a nice-to-have - it’s the (gold) standard.

.png)

👉 What you can do now:

- Focus: Use behavioral data and referral tracking to surface high-intent leads, so you can focus energy on them.

- Invest: Allocate ad budgets on ZIP codes and channels with real conversion signals that you know are working.

- Attribute: Track attribution beyond form fills, by matching your actual home sales to specific marketing efforts.

💡 Audience Town’s Attribution Add-On does exactly this.

Regional Disparities Are Growing

Again, I think Olsen described it well: industry thrash. (Cue Metallica!) Some metros are still booming. Others are softening. Inventory varies wildly.

Southeastern metros like Charleston are still growing. Coastal California and parts of the Midwest are pulling back. Inventory is high in some places, nonexistent in others. And no national average can help you if you’re trying to sell homes in ZIP 29492.

Market performance is increasingly uneven by sector and location. “You can’t plan by averages. You have to plan ZIP by ZIP.”

In other words, you need hyperlocal competitive intelligence to win in 2026. The good news? That’s available today from Audience Town.

👉 What you can do now:

- Go Local: Use ZIP-level data for everything from land strategy to campaign targeting.

- Align: Talk to sales, since they’re your boots on the ground.

- Blend: Layer frontline insight with trusted analytics for a full picture.

🔍 Planning for 2026: Optionality Is the Strategy

The Builder’s Daily recently outlined four future scenarios: status quo, resilience, disruption, or collapse. Most builders aren’t betting on just one, they’re building in optionality.

That means:

- Using buyer data to understand who’s ready to act and who’s not

- Prioritizing market-level decision-making, not just regional

- Investing in tools that track performance and prove ROI

- Staying agile as Fed policy, inflation, and AI continue to evolve

“You can’t control mortgage rates,” Olsen reminded attendees. “But you can control your offer, and how well it meets this moment.”

Bottom Line

You don’t need good national headlines. You need local signals, behavioral insight, and tools to help you act quickly.

Because there isn’t one America.

There are many.

And your America is the only one that matters.

Audience Town helps you know who's moving in your market, where, and why..

.gif)

.png)

.png)

.png)